CMB Wing Lung Bank Limited (“the Bank”) proudly presents a brand new robo advisory service, Wealth-Tech Services, which provides you with professional investment advices through analysis of algorithms. The Service creates a customized fund portfolios for customers, and monitors each fund portfolio every second around the clock. Wealth-Tech Services is your technology partner in wealth management.

What is Wealth-Tech Services

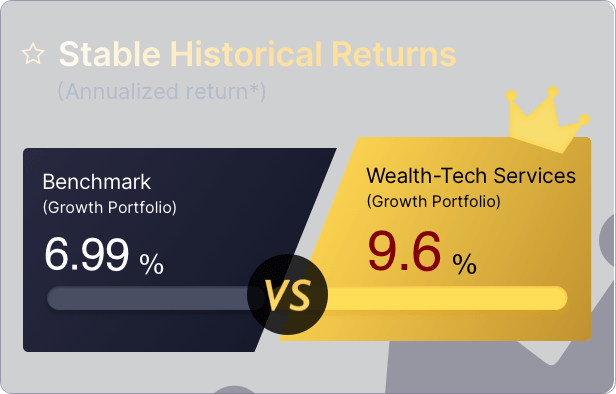

The Reasons of choosing

Wealth-Tech Services

CMB Wing Lung Bank cooperates with a licensed robo investment advisory company

The Bank cooperates with AQUMON, a robo investment advisory firm with licenses type 1, 4 and 9 of the Hong Kong Securities and Futures Commission (SFC), providing professional investment advices and customized fund portfolios to customers. Customers’ assets will be kept in custody by the Bank to make transactions more assured.

Deploying algoritmic models to generate fund portfolios to reach asset diversification

Wealth-Tech Services deploys quantitative models to analyse more than 100 factors such as fund size, fund categories, interest rate and past performance, as to select suitable funds out of thousands to form fund portfolio for customers, customers can have multiple fund portfolios in Wealth-Tech Services’ investment portfolio.

Analysing Risk Preferences

Wealth-Tech Services divides risk preferences into 5 categories: Conservative, Stable, Balanced, Growth and Aggressive. After completing the Investment Risk Profiling Questionnaire by customers, Wealth-Tech Services will take the risk preference results as one of the criteria for investment analysis.

Customizing Fund Portfolios

Everyone’s risk preferences and market views are different. Wealth-Tech Services considers each customer’s individual investment preferences such as geographic locations, industry sectors, and risk preference and etc., to formulate customized and personalized investment plan to fulfill different investment needs. Wealth-Tech Services will provide different tailored fund portfolios for each customer with different preferences.

For example, even 2 customers with the same risk preference as Conservative, Wealth-Tech Services would generate fund portfolios with different varieties of funds and fund weightings since those 2 customers selected different industry sectors. Wealth-Tech Services would generate more than 1 customized and personalized fund portfolios for customer to subscribe, and there is no limitation on subscribing the number of fund portfolios which will then form the whole investment portfolios in Wealth-Tech Services.

Providing 24x7 Monitoring Services

Wealth-Tech Services’ real time monitoring services run 24x7. The system alerts customers with rebalancing recommendations in response to market changes.

$0 Handling Fee and Trading Fee

All charges are transparent. There is no hidden handling fee nor trading fee. All the handling fee for subscription, redemption and rebalancing services has been waived. Only 1% annualized Service Fee # will be charged monthly for Wealth-Tech Services.

# Service Fee of 1% p.a. will be charged monthly on the customers’ total value of Wealth-Tech Services fund portfolios (accrued daily and charged monthly). Monthly Service Fee = 1% of the total values of Wealth-Tech Services fund portfolios / number of days in year.

Investment amount of Wealth-Tech Services

The minimum investment amount is USD4000.

Latest Promotion

From now (29 March 2021) to 31 December 2021 (“this Period”), customers who participate in this new Services will enjoy $0 Service Fee, as the Bank will waive the 1% p.a. Service Fee in this Period.

Please logon CMB Wing Lung Bank Wintech Application (“Wintech”), click “All”- “Wealth Management”, enter Wealth-Tech Services to subscript investment portfolios.