Steps of Online Margin Securities Trading Account Opening:

Step 1: Logon to Personal NET Banking Services.

Step 2: Input Logon ID, Password and Verification Code to logon NET Banking Services.

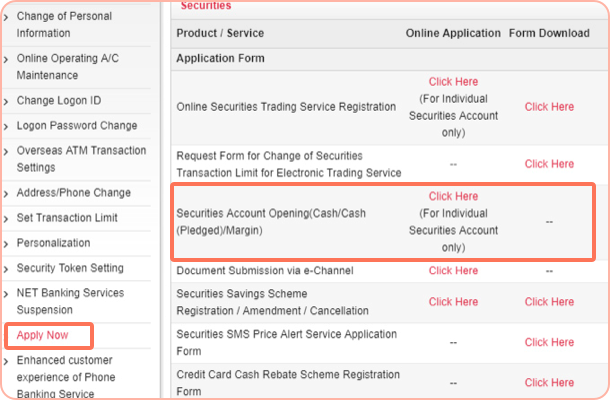

Step 3: Click “My Settings”> “Apply Now”> “Securities”> “Securities Account Opening (Cash/Cash (Pledged)/Margin) - Click Here”.

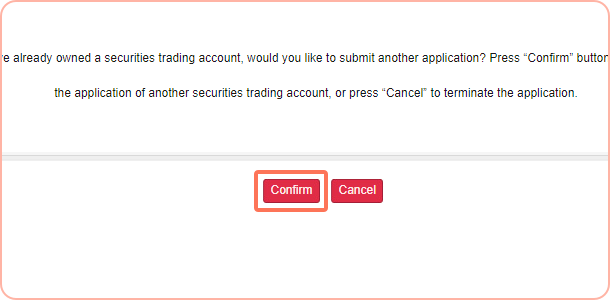

Step 4: If you have already owned a Cash Securities Trading Account or Cash (Pledged) Securities Trading Account, click “Confirm” to continue to the application of another Margin Securities Trading Account. If you do not own Securities Account, this page will not be shown.

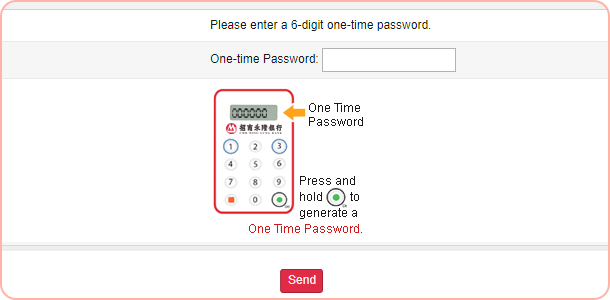

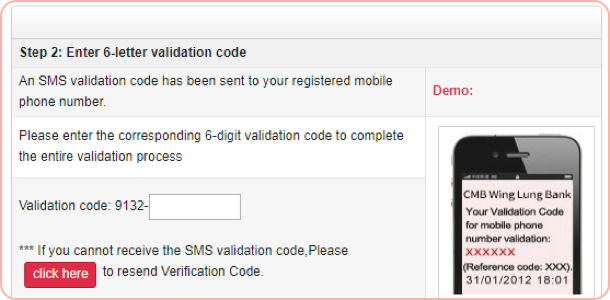

Step 5: Use Security Token or SMS One-Time-Password to validate identification.

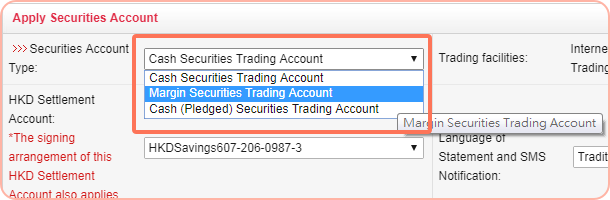

Step 6: Choose “Margin Securities Trading Account” for Securities Account Type, then input required information as instructed.

Step 7: After the application is submitted successfully, you will receive a SMS/email to confirm the submission of your application. Upon successful opening of Margin Securities Trading Account, the Bank will send another SMS/email to notify you so that you can transfer securities to the Bank, use margin financing and trade securities.

Warning: To borrow or not to borrow? Borrow only if you can repay!

Risk Disclosure

Transactions conducted through financing obtained through pledge loans are highly risky. The losses you may suffer could exceed the amount of the cash and other assets you have deposited as pledges with us. You could be asked within a short time to deposit extra margin or pay up for the interest. If you fail to pay the required margin or interest before the designated deadline, your pledge is likely to be sold without your consent. In addition, you are also liable for any shortage of fund in your account and for the interest due. Therefore, you are kindly advised to ponder if such financing arrangements suit your financial status and investment strategies.

Under certain market conditions, you may find it difficult or impossible to liquidate a position. In these circumstances, your loss will not be limited to your margin and may be a substantial amount in addition. You should not participate in margin trading unless you are willing to assume the risks associated with such transaction and are financially able to absorb losses.